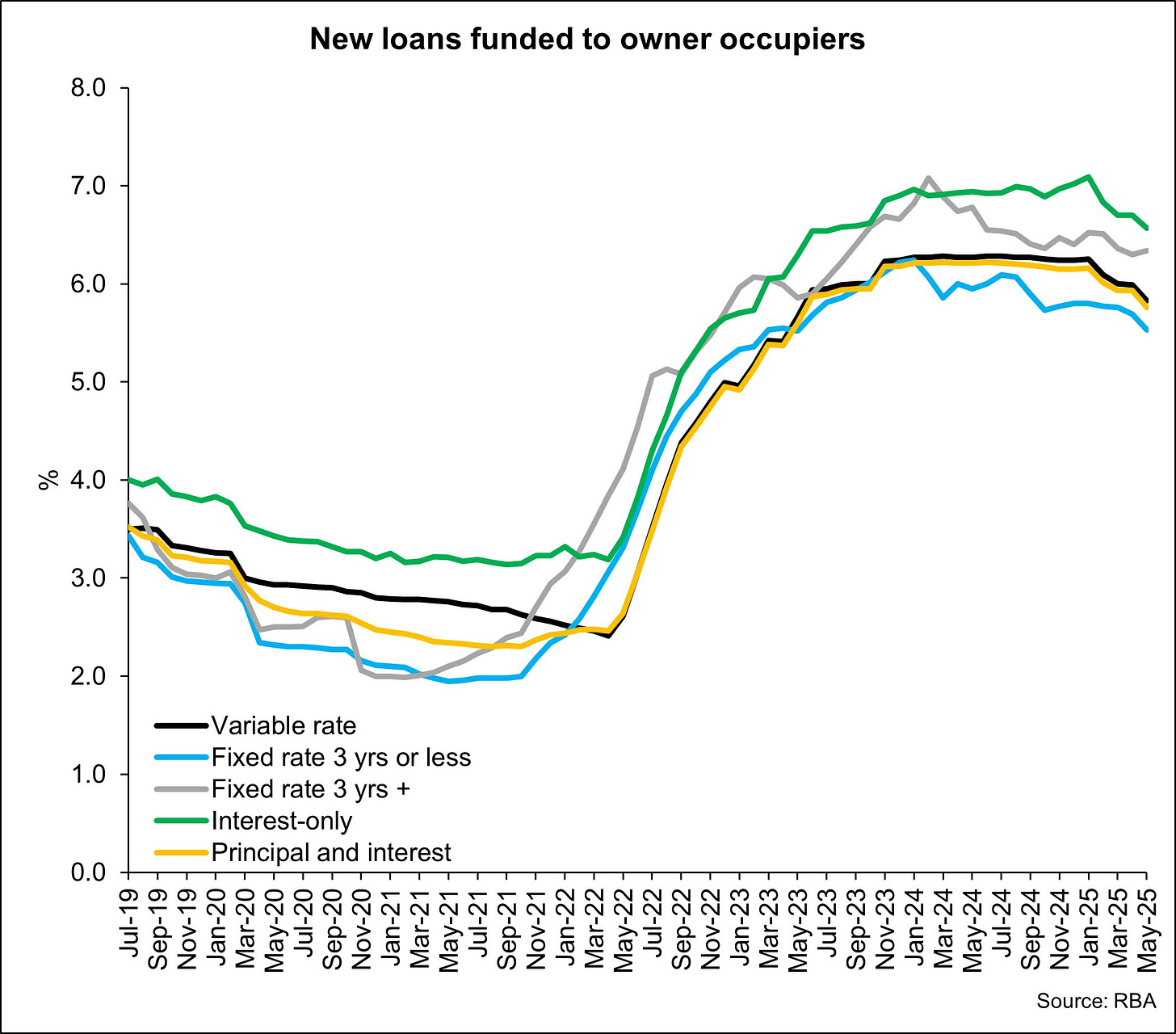

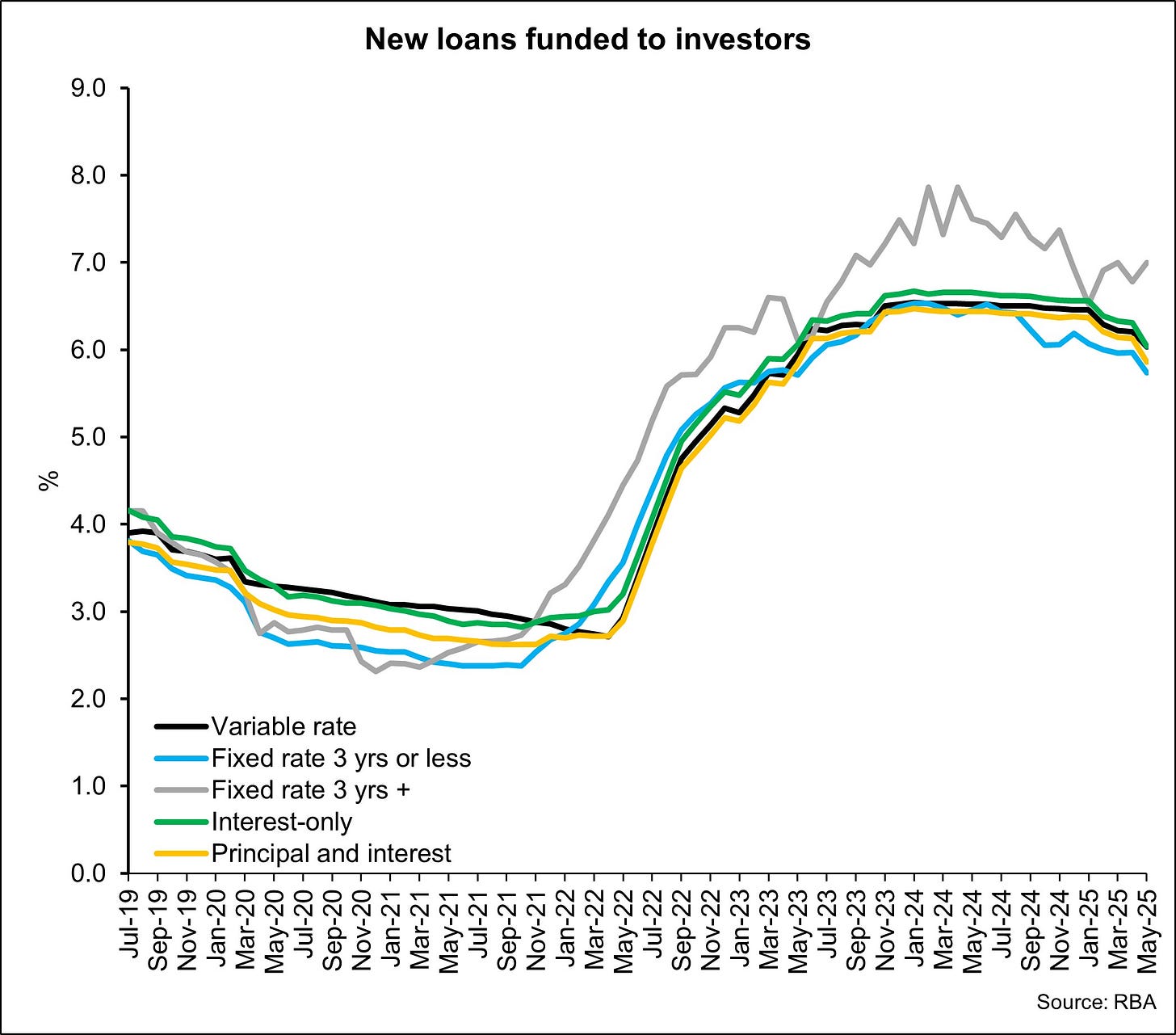

The latest home loan interest rate data from the Reserve Bank (RBA) provides an update of average rates across all institutions up to May 2025.

With a cash rate reduction over the month, the average new variable rate for owner occupiers fell from 5.99% to 5.83% a 16 basis point fall. Fixed rates for 3 years or less fell 16 basis points to 5.53%, fixed rates for more than 3 years rose 4 basis points to 6.34%, interest-only fell 13 basis points to 6.57% and principal and interest fell 17 basis points to 5.76%.

Average new home loan rates to investors were 18 basis points lower over the month reaching 6.03%. Fixed rates for 3 years or less fell 23 basis points to 5.74%, fixed rates for more than 3 years rose 22 basis points to 7%, interest-only fell 27 basis points to 6.04% and principal and interest fell 27 basis points to 5.86%.

Here’s a link to the latest data.